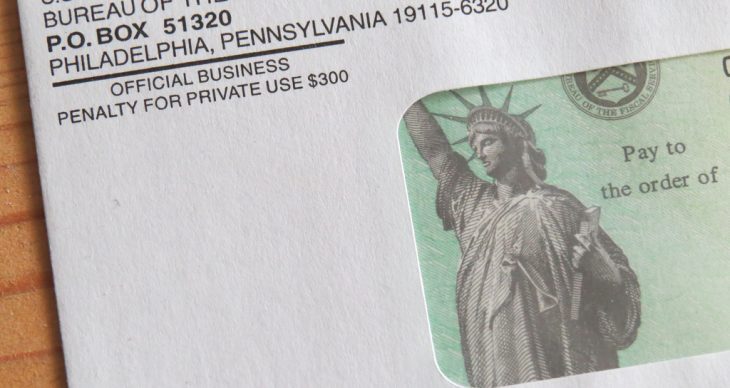

The primary benefit of this type of cash assistance is the infusion of financial stability back into your life. Another benefit is the overall convenience with which this is accomplished. If you filed your taxes in 2019 or 2020 no extra steps are needed to get your stimulus checks.

Whatever method you regularly use to make payments to the IRS or receive your tax refunds is automatically used to deliver your stimulus money. Some people request to receive a prepaid Visa debit card instead of a paper check in the mail or a direct deposit transaction. Provided you have qualified, the disbursement process is automatic regardless of the delivery method.

Differences with IRS non-filers for stimulus check payments are significant. Non-filers are required to file taxes as a condition for receiving their checks. Some people are not required to file taxes for non-stimulus purposes because they are exempt for a variety of reasons or their maximum earned income was below the taxable requirements.

People in this situation are encouraged to take advantage of the TaxAct Stimulus Registration process. TaxAct Stimulus Registration was designed to help countless Americans safely submit their required information to the IRS for review, acceptance, processing and disbursement of their Economic Impact Payments.

Using the TaxAct Stimulus Registration process is appropriate under the following scenarios:

- You receive no Social Security benefits.

- You receive no Social Security Income (SSI).

- You receive no Social Security Disability Income (SSDI).

- You are legally not required to file taxes.

So, where is your missing stimulus money? Qualified people who did not receive their stimulus checks are permitted to claim the money as a Recovery Rebate Credit when filing 2020 tax returns. Use Form 1040 or Form 1040-SR to claim your funds.

These forms are also usable to claim your stimulus money if you are not required to file taxes in 2020. The IRS website also provides a Get My Payment tool, which allows you to check on the status of your stimulus funds.

What’s more, households in the United States who are receiving stimulus checks, and yet, are still struggling financially should not worry. The government also has other programs that can provide you with the cash assistance you need to help pay your bills and cover the necessities. If you need further assistance after you receive your third stimulus check, you might consider applying for additional government programs including TANF, SNAP, Medicaid, CCDF, Section 8 Housing, and more!

By Admin –